Top Fraud Prevention & Detection Solutions in Fintech

Feb 22, 2024 🕒 3 min read

The Problem of FinTech Fraud Prevention

It can be tough implementing the right fraud protection for your fintech company. Your unique product presents unique challenges. First, you have to identify your problems with limited data observability. Next, you have to discover the right solutions for your business in a sea of thousands of vendors. Even once you’ve created an ideal solution, featuring nuanced rules and solutions, you’re met with organizational politics and resource constraints. This puts most ideal fraud strategies out of reach.

An elegant solution

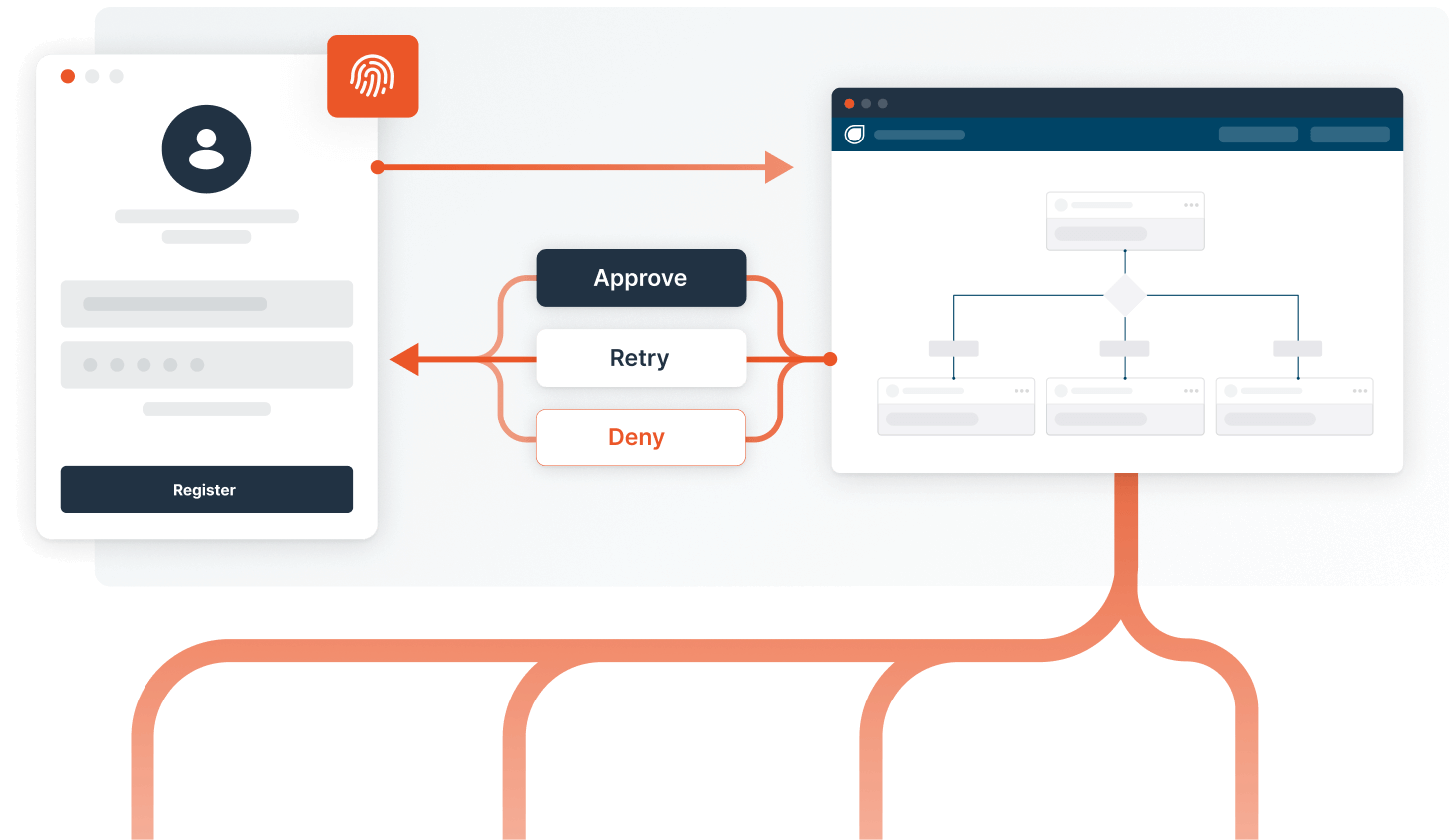

Dodgeball is a fraud orchestration platform that expedites fraud engineering and removes the above constraints.

A marketplace of all the best fraud integrations lets you launch your entire vision in days. Integration analytics, experimentation, & monitoring measures the impact of your fraud strategy, identifies gaps where additional attention is needed, and gives your engineering team peace of mind to move on to other initiatives. End-to-end product journey visibility enables you to automate most fraud decisions, conduct faster and more accurate manual investigations, and launch sophisticated decisioning.

These pillars together enable fintech companies to scale, grow, and launch new products at the speed of startups without the looming fear of fraud.

Below you’ll find a list of all the potential solutions to fraud prevention, fraud detection, and policy abuse. Chat with Dodgeball to learn how you can expedite fraud engineering and launch any and all solutions that you need today.

List of solutions:

2FA/MFA Prevent unauthorized access and account takeover with extra layers of authentication.

- Example: An online banking customer is prompted to enter a code received via SMS, in addition to their password, before accessing their account. This prevents a fraudster who has obtained the password from gaining unauthorized access.

- Vendors: Dodgeball, Twilio

3DS Reduce unauthorized online transactions with secure payment authentication.

- Example: During an online purchase, the customer is redirected to their bank's authentication page to verify their identity, ensuring the cardholder authorizes the transaction.

- Vendors: Cardinal by Visa

Anti-Money Laundering (AML) Comply with regulations and reduce financial crime by monitoring transactions for suspicious money laundering activity.

- Example: A series of large, irregular transactions are flagged by the AML system, prompting an investigation that reveals a money laundering operation using a legitimate business as a front.

- Vendors: Unit21, ComplyAdvantage, NICE Actimize

Bank Verification Prevent fraudulent transactions and chargebacks by verifying bank account information in real-time.

- Example: Before processing a payment, a merchant verifies the payer's bank account details, preventing a fraudulent transaction using stolen bank account information.

- Vendors: Plaid

Biometrics Add an extra layer of security with secure authentication using fingerprints, facial recognition, or other biological identifiers.

- Example: A user must authenticate via facial recognition before accessing sensitive account information, thwarting an identity thief who does not physically match the account holder.

- Vendors: SecuredTouch

Blockchain analysis Enhance trust and compliance by analyzing a secure and tamper-proof ledger of wallets and transactions.

- Example: Blockchain analysis tools trace the history of a suspicious transaction to a wallet known for illegal activities, enabling the prevention of a fraudulent transaction.

- Vendors: Chainalysis, Sardine, TRM Labs

Bot Fake Accounts Uncover automated bots manipulating systems or creating fake identities for fraudulent purposes.

- Example: An online retailer detects and blocks an attempt by bots to create multiple accounts using synthetic identities for exploiting new user discounts.

- Vendors: Arkose, Datadome, Human, Kasada

Call Center Identify suspicious patterns and improve detection by monitoring call center interactions

- Example: Call center software flags a call where the caller attempts multiple times to obtain account information without proper authentication, indicating a potential vishing attempt.

- Vendors: Pindrop, Smart numbers

Chargeback Automation Reduce manual effort and costs by streamlining the chargeback process for fraudulent transactions.

- Example: An automated system efficiently gathers transaction evidence and submits it to the bank, contesting a chargeback claim where the customer denies making a legitimate purchase.

- Vendors: Chargebacks911, Chargeblast, Chargehound, Ethoca, Justt, Mitigator, Verifi

Dark Web Monitoring Scan dark web forums and marketplaces to protect against potential attacks and leaked customer data.

- Example: Dark web monitoring alerts a company that employee login credentials have been found for sale, enabling them to prompt affected employees to secure their accounts promptly.

- Vendors: RecordedFuture, SpyCloud

Data Enrichment

- Example: Data enrichment involves enhancing, refining, or improving raw data with additional context or information from external sources, making it more valuable and actionable.

- Vendors: AtData, People Data Labs, Spade

Device Fingerprinting Detect anomalies and potential account takeovers by analyzing user demographics and device characteristics.

- Example: An online service detects a login attempt from a device never used before by the account holder, along with discrepancies in device characteristics, prompting additional verification steps.

- Vendors: Fingerprint, Incognia

Email Intelligence Identify malicious individuals by analyzing email details. (Email Age, Domain Risk, Syntax Analysis)

- Example: Upon registration, an online platform flags an email with a newly created domain and suspicious syntax, indicative of a phishing attempt to create multiple fake accounts.

- Vendors: Deduce, Ekata, LexisNexis Emailage

Fraud Models (ML/AI) Predict and prevent fraudulent transactions, saving you money and protecting customers.

- Example: An AI model analyzes transaction patterns and flags a series of high-value transactions in a short period as suspicious, preventing potential fraud on a stolen credit card.

- Vendors: Kount, Forter, Ravelin, Sardine, SEON, Sift, Signifyd, Stripe Radar

Fraud Orchestration (App-Level) The integration and coordination of various fraud solutions, tools, and data sources within a digital application, so as to be able to influence the user journey.

- Example: An online retailer integrates its device fingerprinting, IP intelligence, and behavioral analytics tools into a single fraud orchestration platform. When a new account creation attempt is detected, the platform simultaneously checks the device's risk score, analyzes the IP address for any previous fraudulent history, and evaluates the behavior against known fraud patterns. The orchestrated system identifies a coordinated attack using stolen identities from various high-risk locations. By automating the response, the retailer immediately blocks the fraudulent accounts and prevents the attackers from making unauthorized purchases.

- Vendors: Dodgeball

Geolocation Deter location-based fraud and identify suspicious activity outside expected regions by tracking user location.

- Example: A transaction attempt from a country where the cardholder has never made purchases before is flagged for additional verification, preventing potential CNP fraud.

- Vendors: WhoIsXML, digital element, maxmind

IP Intelligence Flag risky transactions based on phone reputation

- Example: A neobank receives an withdrawal request from an IP address located in a high-risk country and using a proxy server, prompting a review before processing the order.

- Vendors: Incognia, IP Quality Score

Peer-to-Peer Intelligence Monitor peer-to-peer networks for suspicious activity related to stolen goods or money laundering.

- Example: Suspicious transactions involving high-value items traded rapidly between accounts on a peer-to-peer network are flagged as potential money laundering.

- Vendors: Identiq

Phone Intelligence Flag risky transactions based on phone reputation (Age, Carrier)

- Example: A financial institution flags an account change request linked to a phone number recently ported to a new carrier, a common tactic in account takeover schemes.

- Vendors: Ekata, Prove

PII Verification Ensure customer information are legitimate, preventing fraudulent accounts and chargebacks.

- Example: An online lending platform requires document verification before loan approval, detecting a fake ID submission and preventing identity fraud.

- Vendors: AtData, Ekata, Pipl

Identity/Document Verification Ensure customer identities are true and legitimate, preventing fraudulent accounts and chargebacks.

- Example: A cryptocurrency startup requires document verification before deploying funds.

- Vendors: Onfido, Persona, Socure, Veriff

Session Replay Identify suspicious patterns and improve detection by monitoring live user sessions.

- Example: Session replay reveals unusual activity from a user's account, accessing sensitive customer data without authorization, indicating a potential insider threat.

- Vendors: Dodgeball, Fullstory

Site Behavior Analytics Detect bots, suspicious interactions, and potential fraud attempts by analyzing user behavior on websites and apps.

- Example: A sudden influx of traffic with repetitive patterns on an fintech site is identified as a botnet attempting to ATO, enabling the site to block the attack and preserve funds of legitimate customers.

- Vendors: Arkose, Datadome, Dodgeball, Human, Kasada

Looking to orchestrate your fintech fraud strategy ?

Chat with us