How To Automate Manual Reviews and Investigations for Fraud

Feb 5, 2024 🕒 4 min read

Introduction

Fraud losses soar, demanding smarter solutions. Manual reviews and investigations, rife with delays and inconsistencies, can't keep pace. Enter automation: a game-changer for efficiency, accuracy, and scalability.

Manual review bottlenecks breed frustration and losses. High volumes slow reviews, while human judgments introduce error and bias. As fraudsters evolve, the system strains, leaving businesses vulnerable. Staffing costs and false positives drain profits, highlighting the need for change.

Dodgeball steps up with a multi-faceted approach to fraud prevention. By harnessing advanced rules and user journey analytics, it automatically flags suspicious activities, streamlining the review process. A unified interface for no-code business logic, integration analytics, and alerts ensure comprehensive, continuous, and effective fraud prevention.

Automation empowers businesses to fight back. Sophisticated detection algorithms, fed by diverse data sources, analyze patterns and identify anomalies with precision. Fraud automation allows you to combine various verdicts and data sources to fight fraud in real-time, reduce errors, and scale effectively.

Beyond operational gains, automation delivers cost savings and scalability. Reduced reliance on subjective judgments minimizes bias and frees up resources, while lower false positives shrink financial losses. The benefits are real, as numerous companies integrating these solutions have witnessed dramatic falls in fraud incidents.

Final Takeaway

The future of fraud management is automated, but not human-less. Technology is a powerful ally, but human oversight remains crucial. For businesses seeking security and efficiency, human-augmented automation is the path forward.

Pain Points

- Inefficiency: Backlogs, high review volume, delayed decisions.

- Inconsistency: Subjective judgments, potential for bias or mistakes.

- Scalability: Difficulty keeping up with rising fraud attempts.

- Cost: High personnel expenses, lost revenue from false positives.

Benefits

- Increased efficiency and accuracy: faster decisions, reduced review workload, minimized human error.

- Improved scalability: handle growing transaction volumes without adding personnel.

- Enhanced fraud decision: unlock previously impossible decisions. Use advanced decisions to catch sophisticated scams undetected by manual review.

- Reduced costs: save resources by streamlining the review process, minimizing false positives.

- Analytics: leverage analytics to continuously improve fraud prevention strategies.

Here's a step-by-step approach on how to automate manual fraud reviews and investigations:

- Data Collection and Analysis

- Gather historical data: Start by collecting historical transaction data, including both legitimate and fraudulent activities. This data should encompass various attributes such as transaction amount, frequency, user behavior patterns, location data, and any other relevant metrics.

- Analyze for patterns: Analyze this data to identify patterns and anomalies that typically indicate fraudulent activity. Look for commonalities in fraudulent transactions and distinguish them from legitimate ones.

- Establishing Rules and Criteria

- Define clear rules: Based on your analysis, establish a set of rules that can automatically flag transactions as suspicious. These rules might include unusual transaction amounts, rapid frequency of transactions, or transactions from high-risk locations.

- Criteria for automatic decisions: Set criteria for transactions to be automatically accepted or rejected. For example, transactions within a certain low-risk threshold can be auto-accepted, while those matching known fraud patterns can be auto-rejected.

- Implementing Fraud Models

- Develop or integrate predictive models: These models can analyze transactions in real-time and score them based on the likelihood of being fraudulent.

- Continuous Learning: Ensure that your models are continuously updated with new data to adapt to evolving fraud tactics.

- Integrating a Decision Engine

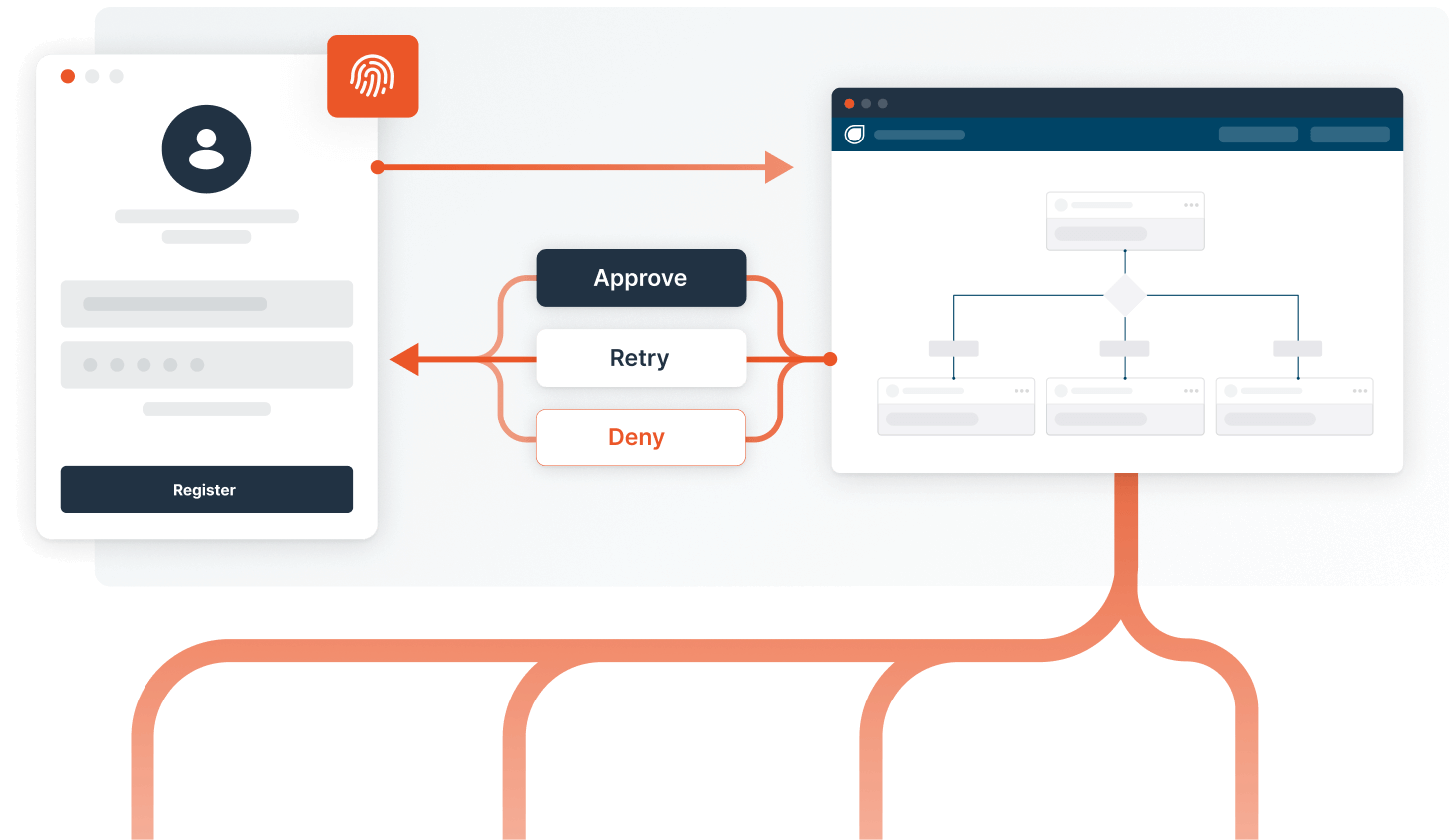

- Automate decision-making: Use a decision engine that integrates your rules and machine learning models. This engine should be able to process transactions in real-time, applying the rules and ML scores to make instant decisions.

- Thresholds for manual review: Set thresholds for transactions that require manual review. For instance, transactions that score in a gray area between clearly legitimate and clearly fraudulent should be flagged for manual inspection.

- Creating a Feedback Loop

- Monitor and adjust: Regularly review the outcomes of both automated and manual decisions. This feedback is crucial for adjusting your rules and improving your ML models.

- Incorporate team insights: Include insights from your manual review team to refine the decision-making process, as they might identify new fraud patterns or legitimate transaction types.

- Implementing the Workflow

- Integration with existing systems: Ensure that the automated workflow is well-integrated with your existing transaction processing systems for seamless operation.

- User interface for manual reviews and investigations: Develop or integrate a user-friendly interface that allows your team to efficiently review flagged transactions, add notes, and make decisions.

- Training and Awareness

- Train your team: Ensure that your team is well-trained in using the system, understanding the criteria for reviews and investigations, and staying updated on the latest fraud trends.

- Promote awareness: Keep all stakeholders informed about the importance of fraud detection and the role of automated workflows in safeguarding the business and revenue.

By following these steps, you can set up an effective automated workflow for fraud detection that optimizes your team's efforts, reduces the risk of fraud, and maintains a good customer experience.

Fortune 500 Example

This example is especially relevant to Directors and Heads of Fraud. One Fortune 500 powerhouse moved away from manually reviewing one line of business and deployed a hyper-automated core flow that filtered bad actors, validated businesses, and delivered instant verdicts – all without manual oversight.

Mastercard Fraud Intelligence phone lookups to disrupt fraudsters using spam phone numbers. Dun & Bradstreet paints a picture of legitimacy for SMBs, while Dodgeball MFA guards new and suspicious devices. All this intel feeds into Kount's risk-scoring engine, generating lightning-fast approve/deny decisions that block fraudsters instantly.

The result? Double-digit millions in losses protected. Human analysts were freed for strategic intel gathering, a streamlined user experience, and security investigations. Automation is the key to turning your application into a fortress against fraud.

Want to automate manual fraud reviews ?

Chat with us